Despite impressive growth in cloud services, Microsoft (NASDAQ:MSFT) posted a 5% y/y decline in revenue and a non-GAAP operating income decline of 3%. Exclusive of the recent $8.4 billion write down plus restructuring charges due to the Nokia (NYSE:NOK) purchase, Microsoft's earnings were weighed down by Windows licensing and phone hardware. The release of Windows 10 will only mark the beginning of a long process of returning Windows revenue to growth.

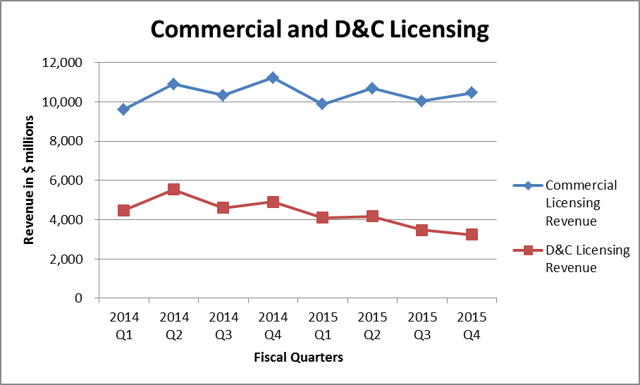

The XP ScapegoatIn their earnings briefing slides and discussion, Microsoft often referred to the XP refresh cycle by way of explaining y/y declines in Devices and Consumer (D&C) licensing and Commercial licensing. Granted, the end of support for XP in April 2014 did provide a boost to sales, but the comps only become difficult for D&C licensing. Commercial licensing (volume Windows and Office licensing to corporate customers) doesn't suffer nearly so much compared to last year, as the chart below shows.

(click to enlarge)

D&C licensing declined 34% y/y in fiscal 2015 Q4, driven by revenue declines in OEM licensing, Windows Phone licensing, and Office consumer licensing.

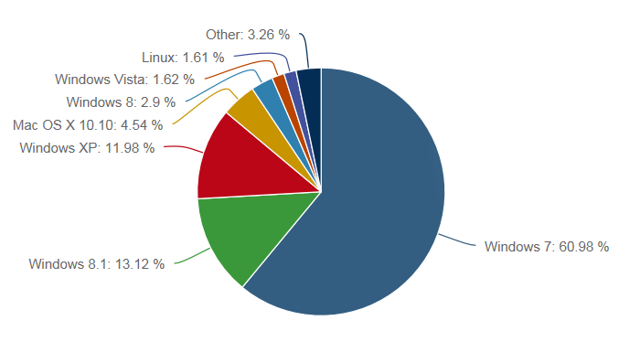

The downward trend in D&C licensing speaks to the larger problem that Microsoft has had in the consumer space. Windows 8.x simply hasn't been very popular, and still isn't, judging by netmarketshare.com breakdown of usage by OS version shown below:

(click to enlarge)

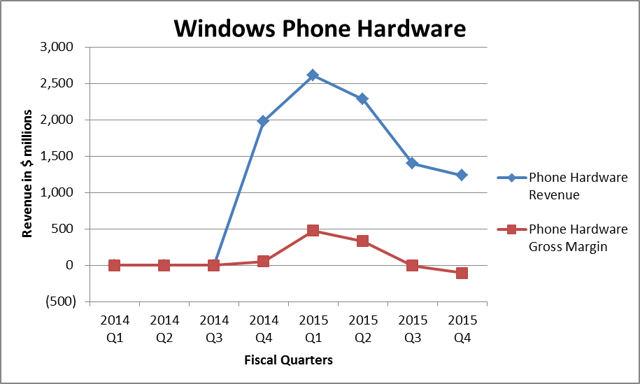

In addition to revolutionizing the PC, Windows 8 was to be Microsoft's ticket into the world of the smartphone. The fortunes of Windows Phone 8 in many ways mirror that of Windows 8. Windows Phone hardware briefly enjoyed increasing revenue after the Nokia acquisition, but has declined precipitously in fiscal 2015.

(click to enlarge)

The collapse of the phone hardware business can't be blamed on the XP refresh cycle.

Windows 10 to the Rescue?In my recent article Microsoft 'Mobilizes' The PC, I discussed Microsoft's strategy of focusing on its core PC ecosystem and converting it to the modern mobile device paradigm. This means among other things, an App store (introduced with Win8), over the air software updates, and the ability to accommodate mobile device platforms such as tablets, convertibles, and phones. Windows 10 will spearhead this conversion.

I have no doubt that Windows 10 will be successful where Win8 largely failed. As Microsoft enters its new fiscal year, my thinking about Windows 10 has shifted from a focus on the technical achievement it represents to its financial impact.

No matter how good a technical solution Windows 10 is, it can't really be considered successful if it doesn't turn around the decline in revenue for Windows 10 consumer and commercial licensing. Here, the real question becomes, when does that occur?

Microsoft's guidance for fiscal Q1 was not particularly encouraging. D&C Licensing is expected to have revenue of $3.4-3.6 billion, which at the midpoint represents a 14.5% decline y/y. Commercial licensing is expected to be flat y/y.

Phone hardware guidance was even more discouraging, with expected revenue of $900 million, a y/y decline of 65.5%. Microsoft had gained a slender toehold on smartphones with WinP8, but now seems in danger of losing its hard-won gains.

I'm focusing on these areas because they are really the critical elements of the future Windows (mobile) device ecosystem. This isn't to diminish Microsoft's cloud accomplishments or growth potential. But Windows is simply too important a franchise and computing ecosystem to allow it to fall into stagnation. Clearly, CEO Nadella has no intention of doing so.

But the new strategy of offering Windows 10 as a free upgrade has consequences. The net effect will probably be to depress new hardware sales. Almost everyone with a Win8 device will upgrade to Win10. Many with Win7 will upgrade as well, although I expect to see a core of holdouts as we did with XP, perhaps an even larger group.

With a free Windows 10 upgrade, there's almost no motivation to upgrade hardware. A decline in hardware purchases, both by consumers and businesses, means that OEM licensing will suffer as well in fiscal 2016.

There might be some hope in Commercial licensing, but large corporate customers who upgraded from XP to Win7 will probably stand pat for the time being. So there won't be much help on the Commercial front either.

The Painful YearFiscal 2016 is shaping up to be a really painful one for Windows revenue. Microsoft's guidance is for things to turn up in 2H. I'm very dubious that the revenue situation can improve until Microsoft is out from under the 1-year commitment on free upgrades.

I firmly believe that the free upgrade is the right strategy. Well, it's the only strategy left to Microsoft, having failed to create a significant mobile device ecosystem based on Windows Phone. Being the only strategy doesn't make it a great strategy.

There are headwinds. Smartphones have become the most important personal computing platform on the planet. The lack of presence on this platform puts the whole Windows 10 strategy at risk of becoming irrelevant. In the developing world, where the smartphone is the only personal computing platform available to most people, the Win10 strategy already is irrelevant.

Microsoft will probably not achieve the goal of 1 billion Win10 users in the first year (that isn't the goal). What then? I think Microsoft gets forced into either extending the upgrade period or offering steep discounts on upgrades. Either way, the pain continues.

Eventually, I expect Microsoft to achieve its goal. It is giving itself 2-3 years, after all. What I'm not convinced of is that Microsoft will ever be able to return to the traditional licensing paradigm.

Microsoft's main competitors in mobile devices, Apple (NASDAQ:AAPL) and Google (NASDAQ:GOOG) (NASDAQ:GOOGL) don't try to charge for operating systems. Apple relies mainly on the purchase price of its hardware to cover the cost of OS development and upgrades. Google relies on advertising revenue and fees from OEMs to cover OS development.

Microsoft has yet to adapt fully to the exigencies of competing in the mobile device world, and will probably need to go through a painful period of adjustment, as it develops revenue alternatives within the Win10 ecosystem.

Disclosure: I am/we are long AAPL. (More...)I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Source: Microsoft: The Long Struggle Ahead To Grow Windows Revenue

Comments

Post a Comment